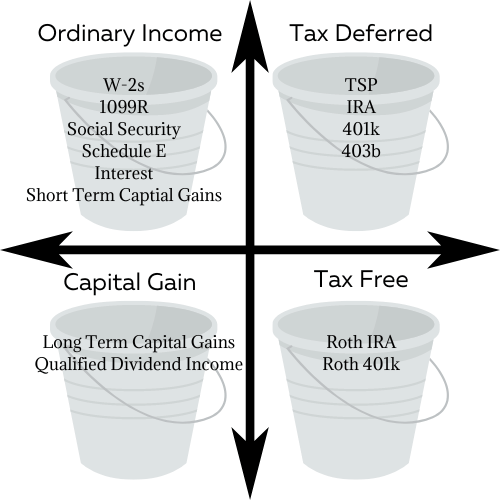

Tax Buckets

September 22, 2022

Welcome back to Powering Your Retirement Radio. This week we are talking about the four different Tax buckets to everyone has access to.

Ordinary Income Bucket

This bucket is your paycheck, regular taxable investments, rental income, and Social Security. It is money you are earning that is taxed at ordinary income rates. Income tax rates are somewhere between 0% to 37%

Tax Deferred Bucket

This bucket is your retirement vehicle that offers a tax deferral of ordinary income tax today. The trade-off is later. All distributions are taxed at ordinary income rates, which may or may not be lower than when you earned the initial money deposited. Again, tax rates are somewhere between 0% to 37%

Capital Gains Bucket

This bucket is regular investments held for over a year. If you own a stock, rental property, or other capital assets. On the dividends, you need to hold the stocks for different periods, generally 61 to 91 days (more info. here). Capital Gain tax rates are somewhere between 0% to 20%. For most people, this will result in a lower tax rate.

Tax-Free Bucket

This bucket is everyone’s favorite bucket, Tax-Free Investments. All growth once you make the investment is Tax-Free. The catch is you are limited to how much you can contribute annually. You can convert other retirement assets unlimitedly, but you have to pay the tax due when you convert. Converting too much at one time can push you into a high tax bracket when you convert.

Leave a Reply Cancel reply

subscribe to my newsletter

© 2022 Powering Your Retirement | Legal | Brand and Website by Lyss House Creative